Can You Claim Worthless Stock Treatment For Cryptocurrency

Cryptocurrency is property as far as the IRS is concerned which means when it loses value theres a tax break. For each of your taxable events calculate your gain or loss from the transaction and record this onto one line of 8949.

Bitcoin Caveat Emptor Buyer Beware Cryptocurrency Btc Usd Seeking Alpha

In 2014 the IRS declared that cryptocurrency such as Bitcoin is treated as property for tax purposes.

Can you claim worthless stock treatment for cryptocurrency. Just as with shares if a cryptocurrency becomes worthless it is possible to make a claim to HMRC that it has become of negligible value. Reporting your lost crypto as an investment loss is the only approach that allows a tax exemption. Treat the worthless ABC stock as a 10050 long-term capital loss.

In 2019 the IRS released further guidance through Revenue Ruling 2019-24 which brought cryptocurrency in even further alignment with equities and other capital assets for tax purposes. You wont be able to deduct the loss yourself because you didnt own the stock when it became worthless. Published on November 18 2019.

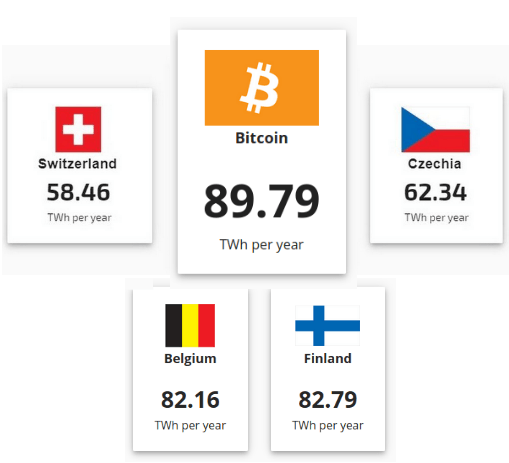

If your cryptocurrency was stolen and classifies as a theft loss its unlikely that you can write this off. The production of Bitcoin and other cryptocurrencies is known as mining which is a complex. You can read more about the details of these rules in the IRS guidance here.

As of March of the current year you can verify that the stock is worthless. You will need to fill out Form 8949 and Form 1040 Schedule D to note your capital gains from cryptocurrency transactions. As such buying some crypto and then merely holding it and not doing anything means it can be treated as a stock.

Since the IRS has treated cryptocurrencies as property for tax purposes and the SEC has indicated it should be treated as a security it is believed that an individual taxpayer can generally. So with over 4000 types of cryptocurrency now available and as payment technology continues to. As you will read below it is unclear which crypto loss scenarios qualify for the investment loss status.

Once you have filled out lines for each of your taxable events sum them up and enter your total net gain or loss at the bottom of 8949 pictured below. For a long-term capital gain of 5000. But your fathers estate can file an amended return for 2004 to claim.

Practical considerations in insolvencies. To abandon a security the taxpayer must permanently surrender and relinquish all rights in the security and receive no consideration in exchange for it. The Revenue Ruling focuses on the tax treatment of a cryptocurrency hard fork you can read my take from 2017 on forks hereIn addition the FAQs address virtual currency topics like.

1165-5i allows taxpayers to solidify their loss claim on worthless securities by formally abandoning the securities. Fill Out Your Tax Forms Properly. Your losses in crypto can offset other capital gains or you can carry forward the losses to future years to offset gains in crypto or other capital gains.

You can also deduct up to 3000 of your losses from your income. Just file Form. If you deduct 3000 from your income but have more losses than that then you can still carry forward the rest of the losses to deduct from future years or to offset future gains.

The IRSs guidance in Notice 2014-21 clarifies various aspects of the tax treatment of cryptocurrency transactions but many questions remain unanswered such as how cryptocurrencies should be treated for international tax reporting eg Report of Foreign Bank and Financial Accounts FBAR Foreign Accounts and Tax Compliance Act FATCA reporting and whether cryptocurrency. This year you also sell 1000 shares of XYZ Corp. In a recent report by INSOL International only 5 of insolvency practitioners IPs said that they had a comprehensive or practicalworking or understanding of crypto-currency.

If you discover you didnt claim a valueless stock loss on your original tax return in the year it became worthless you can file a claim for a credit or refund due to the loss. You can only deduct if you. Form 8949 deals with the disposition of capital assets and you can use it to calculate your gains as well as.

Unlike investment securities like stocks and bonds however which can only be acquired from someone else unless you are the originator of such a security Bitcoin and other cryptocurrencies can be both acquired from someone else and created. On your tax return for this year you can. This is done at the same time as reporting the loss.

Cryptocurrency you are holding onto as a capital asset is treated as property. Yes you need to report crypto losses on IRS Form 8949.

How Much Will Platinum Be Worth If The Dollar Is No Longer The World S Reserve Currency Quora

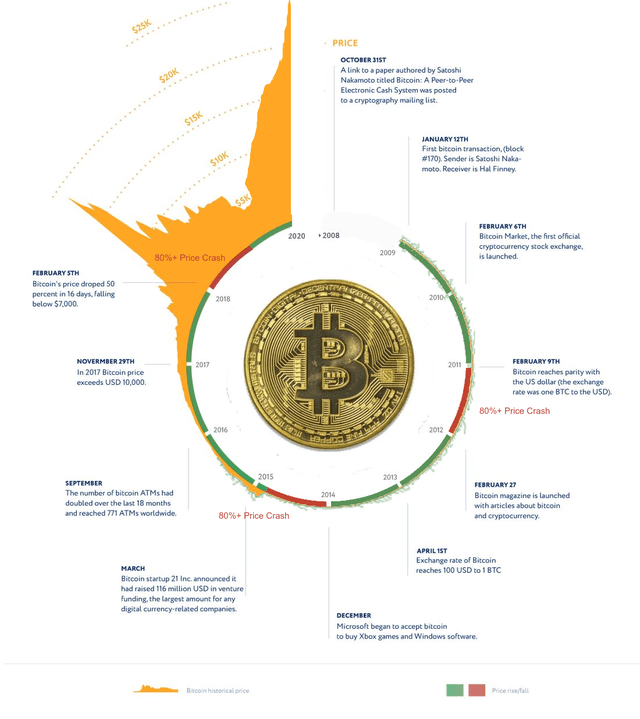

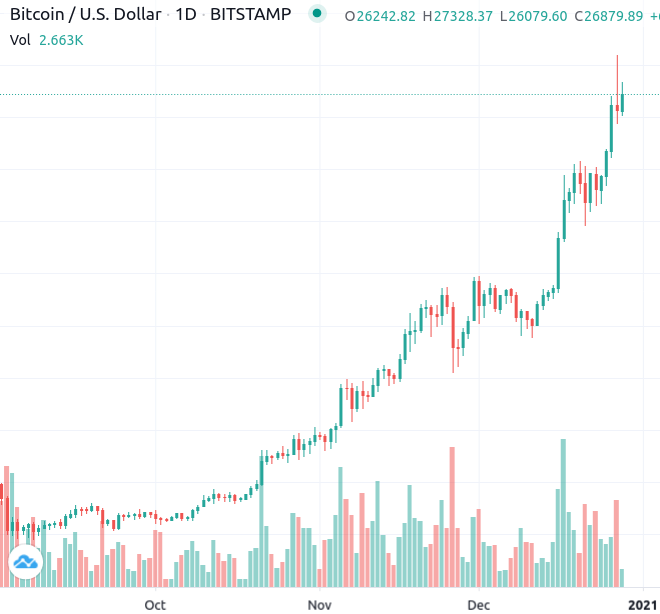

Bitcoin Caveat Emptor Buyer Beware Cryptocurrency Btc Usd Seeking Alpha

Bitcoin Caveat Emptor Buyer Beware Cryptocurrency Btc Usd Seeking Alpha

Bitcoin Caveat Emptor Buyer Beware Cryptocurrency Btc Usd Seeking Alpha

Stock Prediction Cmu Redditsentimentstitle Csv At Master Thoruto Stock Prediction Cmu Github

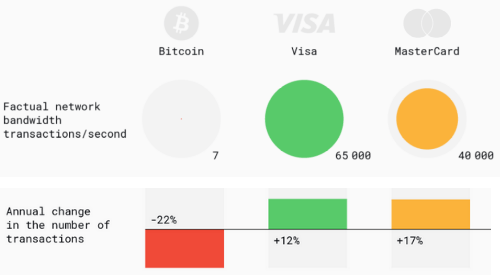

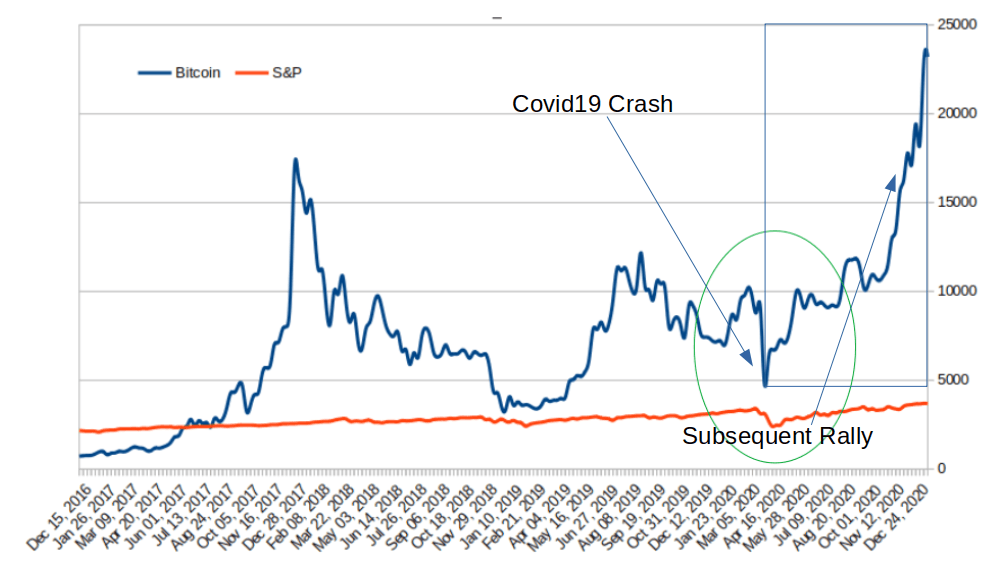

Crypto Research Report June 2020 Eng Pdf Cryptocurrency Bitcoin

Crypto Research Report June 2020 Eng Pdf Cryptocurrency Bitcoin

Bitcoin Caveat Emptor Buyer Beware Cryptocurrency Btc Usd Seeking Alpha

Dao Cryptocurrency Price Current Stock Price Cryptocurrency

The Sec Ripple And Regulation This Case Is More Important Than You Think Cryptocurrency

Crypto Research Report June 2020 Eng Pdf Cryptocurrency Bitcoin

Financial Cryptography Cryptography Archives

Investment Themes Fuller Treacy Money

Bitcoin Caveat Emptor Buyer Beware Cryptocurrency Btc Usd Seeking Alpha

Bitcoin Caveat Emptor Buyer Beware Cryptocurrency Btc Usd Seeking Alpha