Are Cryptocurrency Mining Contracts Part Of Cost Basis

Purchase Price of Crypto Other fees Cost Basis For crypto-to-crypto trading. As you work on importing data into your TokenTax account you may see sales of cryptocurrency with a 0 cost basis warning.

Pdf A Cost Of Carry Based Framework For The Bitcoin Futures Price Modeling

Or more specifically all costs incurred in the acquisition of the asset.

Are cryptocurrency mining contracts part of cost basis. The formula of Cost Basis is simple. However its extremely important to keep track of the acquisition cost with associated fees as it becomes the cost basis of the cryptocurrency and will be used for calculating capital gainslosses for subsequent taxable events ie. Subtract this value from the amount you sold the mined coins for to determine your capital gain or loss.

These are calculated just like other capital gains and losses. That means you can add to your basis any fees or other charges associated with the acquisition. Crypto Mining Costs and Your Taxes Since you incur costs such as electricity and the cost of hardware when mining cryptocurrencies you might be wondering if these costs are deductible on your taxes.

US Tax Law and Cryptocurrency Part 3. One must know the basis price of the Bitcoin they used to buy the coffee then subtract it by the cost of the coffee. Cost Basis Accounting FIFO LIFO HIFO and Specific Identification I am a certified public accountant not an artist that is based out of New Jersey and Im continuing my extensive guide covering the interactions of United States tax law and cryptocurrency.

On October 9th 2019 the IRS released long awaited guidance on the taxation of cryptocurrency through Rev. See the Personal use asset section below to see if you qualify for personal use asset exemption. The cost of the miner and the electricity to run it are not included in any of the elements of the cost base of the cryptocurrency you generate through your hobby mining.

The cost base of the cryptocurrency you generate as mining rewards will be zero. Buying cryptocurrency is not considered a taxable event. Basis means cost.

Calculating the initial basis in a cryptocurrency investment is straightforward. The short answer is yes bitcoin mining expenses are tax deductible. Cost basis includes purchase price plus all other costs associated with purchasing your cryptocurrency fees etc.

IRS does NOT allow you to average your cost basis you can add up your ernings and pay taxes for the first tax event but once you decide to sell your 2020 bitcoin second tax event you are dealing with 2000 transactions that need to be reconciled every 4h NiceHash payout is a separate event. Cost Basis represents how much money you put into purchasing your property ie. Cost basis is the original value of an asset or essentially how much money you put in to acquire that asset.

If the cost basis of the cryptocurrency used in the transaction exceeds A10000 the personal use exemption does not apply and CGT applies as it would normally. More on this below. How much it cost you.

Electricity Expenditures Cost Basis. That is over 2000 event for a full year. If you buy 1 Litecoin for 250 your cost basis is 250 per Litecoin.

Your cost basis is the value of the cryptocurrency at the time it was mined the amount included as ordinary income. The quick answer is Yes you can deduct your cryptocurrency related expenses. Purchase Price of Crypto Other fees Cost Basis For mining.

This means that our algorithm couldnt find a matching purchase for the asset sold or exchanged. Step 1 Determine your cost basis. Capital GainsLoss Sale Price - Cost Basis.

However the amount of the deduction and the manner of taking the deduction depends on whether the mining activity qualifies as a trade or business. You take your cost basis the amount you paid for the currency and calculate how much its gone up or down since that date. From our examples above its easy to see this formula in action.

Without this purchase a cost basis cannot be established. In most cases missing cost basis means that youre missing. For cryptocurrencies it is the purchase price plus brokerage transaction and other fees.

Dollars USD are used to purchase a major cryptocurrency such as bitcoin BTC or ethereum ETH the basis in that investment will be the amount of the fiat currency used to purchase it which is no different from establishing a basis for numerous other capital assets. For crypto assets the cost basis includes the purchase price plus all other costs associated with purchasing the cryptocurrency. You cant claim any expenses you incurred in pursuing a hobby.

For example lets say you used Coinbase to make your crypto purchase and paid a fee of 30 to buy that 2000 of Bitcoin. The taxes on buying a cup of coffee with cryptocurrency are also convoluted. Ruling 2019-24 and an associated FAQSpecific to this article the IRS issued additional guidance on proper cost basis assignment methods.

Forsage Tron Ethereum Earn Money Earn Money Earnings Money Online

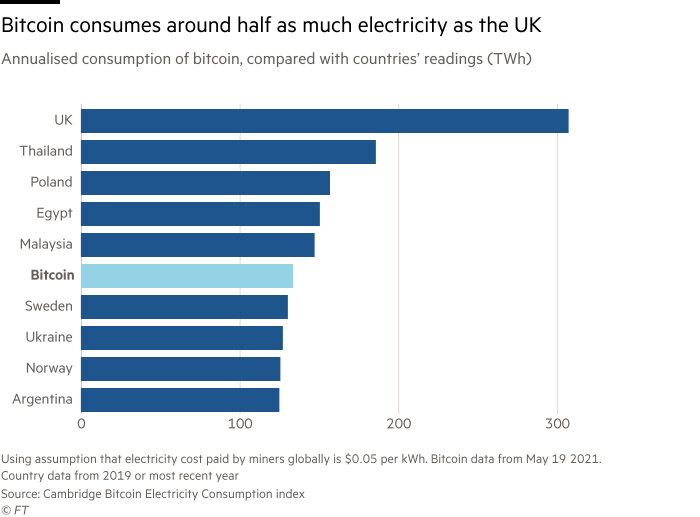

Bitcoin S Growing Energy Problem It S A Dirty Currency Financial Times

Construindo Block Chain S Para Um Planeta Melhor Innovation Startups Sustainability Trends Blockchain Blockchain Technology Blockchain Technology

Pdf Cryptocurrency Mining Transition To Cloud

Blockchain In Automotive Blockchain Autonomous Systems Use Case

Pdf Analysis Of Cryptocurrencies Price Development

La Blockchain Pour Les Nuls Mind Map Blockchain Mind Map Template Mind Map

Bitcoin S Growing Energy Problem It S A Dirty Currency Financial Times

Bitcoin Vs Gold Bitcoin Bitcoin Price Crypto Trading

Bitcoin Trend Bitcoin Backup Bitcoin Gold Where To Buy Bitcoin Stock Price Bitcoin Shop Stock Cryptocurrenc Bitcoin Wallet Best Cryptocurrency Cryptocurrency

Pdf Is Zero Electricity Cost Cryptocurrency Mining Possible Solar Power Bank On Single Board Computers

Zcash Privacy Remains Strongest Of Any Cryptocurrency Even With Recent Chainalysis Elliptic Support Electr Supportive Cryptocurrency Financial Institutions

Are You Interested In Forex Trading Stock Buying And Bitcoin Mining Trading Bitcoin Has Been Made Easy Invest With A Trusted Investing Risk Management Finance

How Can We Make These Transaction Costs Lower Please I Want To Know Why Are More Institutions Networking Their Buy Cryptocurrency Transaction Cost Bitcoin

Qurrex Bursa Kripto Hibrida Multifungsi Cross Platform Dex Exchanger Bitcoin Terperaya Dan Terbaik Jual Beli Cryptocurre Referral Program Investing Referrals

How To Determine The Blockchain App Development Cost Blockchain Link And Learn App Development Cost

Livepeer A Platform For Decentralized Live Video Broadcast On The Internet Open Source Code Technology Projects Platform As A Service

Why Bitcoin Ethereum Are Seen As The New Gold And Silver Ethereum Bitcoin Cryptoira Cryptoirainvestment Ethereum Cryptocurrency Bitcoin Blockchain